I have been paying rent since I left my parents home to go to University. However, I've recently purchased a house. With my experience with both, do I prefer owning or renting? Below are some common pros and cons for each side of the case.

Arguments for rent / against purchase:

- Higher mobility: Flexibility to move as your living requirements change (family grow, job change, school change). You can try to live in different area or house style with little commitment.

- Debt free! No burden and no impact in case of interest rate rise or market crash. You may be equity poor but you are cash rich.

- Flexibility: You can choose to upgrade / downsize any time. If you earn more, you can move up within a few months.

- Tax benefit as rental expense is deductible or can be claimed as non-taxable income

- Low upfront cost and transaction cost. You can move out from your parents before saving a substantial amount for down payment.

- Low maintenance cost: Avoid the recurring costs like property tax, insurance, maintenance.

- Hassle free: Just call the landlord when there is a problem around the house.

When you live in the Big Apple, renting may seem to be the only option that make sense

Argument for purchase / against rent:

- A place to call home: Peace of mind for owning your home. Go home everyday knowing it is yours. Knowing you can stay there even after you retired.

- Equity building: Paying mortgage is equivalent to building your equity, which is an indirect saving in long term. You may be cash poor but you are equity rich. While paying rent is like throwing money in ocean.

- Inflation hedge: Mortgage payment is fixed (assume stable market and interest rate) but rent inflats.

- Tax benefit: mortgage interest and property tax are tax deductible in most countries.

- Flexibility on renovation and home improvement project to make it your dream house.

- Hassle free: You don't have to worry about being kicked out by the landlord and related moving cost.

Who doesn't want to own a detached house with double garage?

There is no right or wrong in this debate. Everyone and every city is different. I personally believe that if you have saved up the down payment, your rent payment can cover the mortgage, property purchase could be a good idea. At the same time (contradicting myself again), renting makes a lot of sense when you just start working, or when rental expense is much lower than mortgage payment on the same house. What should you consider when deciding between renting or buying?

Considerations in deciding between buy vs rent:

- Your income v.s. property price v.s. rent cost: If you can save significant amount even after rental payment; if it cost much less to rent than to own, than you could seriously consider renting before you make the big purchase

- Stage of life are you in: are you ready to settle? Are you ready for the commitment?

- Personal preference. For example, I liked a house close to the park and transit while Mister liked detached houses with proper garage.

- Your age: Can you afford to wait it out?

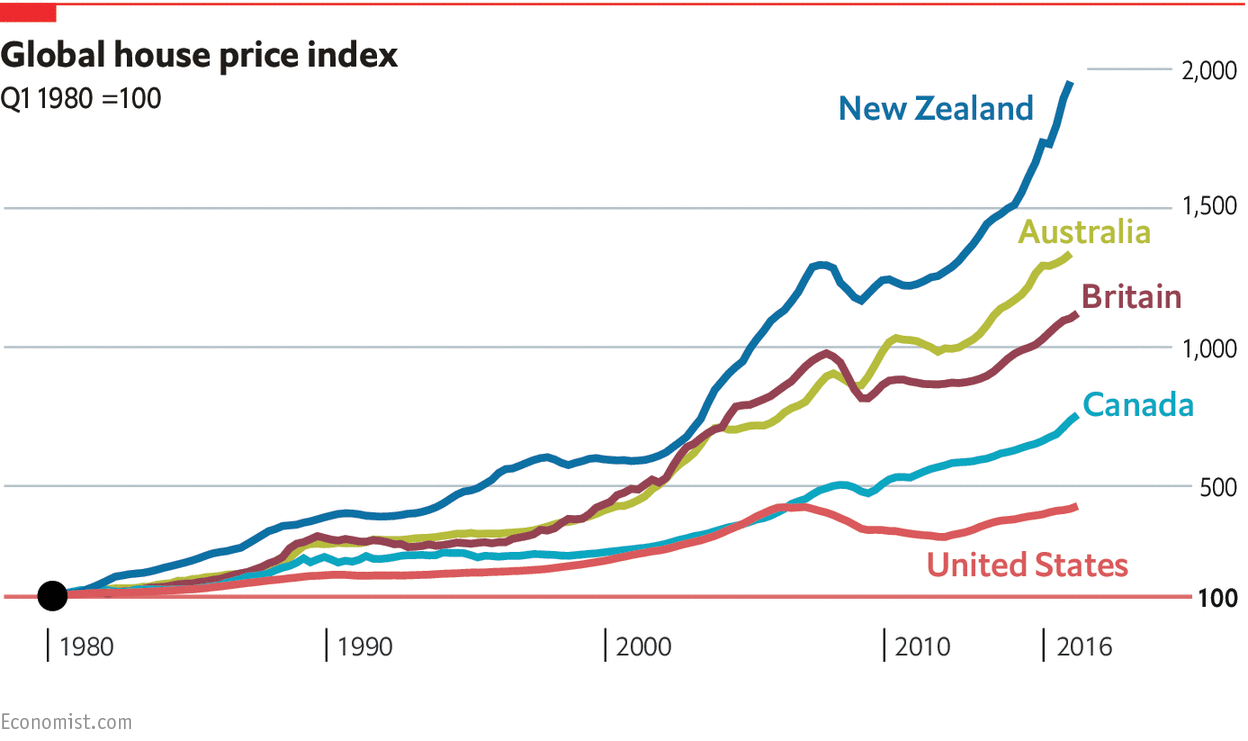

- At this crazy roller coaster market, if you are a fresh grad, you can afford to wait it out and see if the market would cool down.

- However, if you are in your mid-30s, almost 40, you may not have much time to wait, or else you may risk having mortgage payment outstanding way into your retirement.

- Although! If you are young and green, you have time on your side to start growing equity as possible

- Your life style: Do you like the idea of mobility and moving to a new country or city every few years? Do you plan to take gap year off travelling every now and then? If so, renting may be your ideal. However, if you enjoy gardening, home improvement projects, and decorating your home, you should seriously consider owning!

- Can you afford the down payment? This is obvious. Especially if we might be at the brink of a market crash, interest rate hike, you need to put yourself through all sort of stress test to come up with the home purchase budget, and stick to it.

- Market value: I read about this "price-to-rent ratio" on Fidelity where if the ratio is below 20, buying is a better option. Frankly, I haven't really seen a big city home with a price-to-rent ratio below 20. But this can be a good comparison tool when deciding between a few properties and their "monetary value".

Market condition had been a big deterrent for myself. Now that I look back, I feel pretty silly to have waited for so long before making the purchase. Buy vs. Rent debate has many grey areas for considerations that warrant their own blog posts. Let's go through them one by one:

- How much should I spend on my rent?

- The alternative called "rentvesting" where you pay rent and receive rent.

- Considerations for purchasing my first property.

Are you also debating between buying or renting? What are the questions bothering you? Or is this a no-brainer question for you? Do share your thoughts!