What should I be worried about?

Negative equity: Meaning when you sell your house, the selling price cannot even cover outstanding mortgage. You may need to fork out the difference to close the sale. You need the consult the bank on how to settle the difference before selling. If you were hoping to cash out buy selling, it may no longer be an option. It may also be difficult to switch bank on a negative equity mortgage. So you should consider your alternatives before you sell.Bank call loan: If the original mortgage require a minimum loan-to-value ("LTV") ratio, would the bank require you to reduce your loan to meet the LTV? That is usually not required as long as you keep up with your mortgage payment.

What you don't have to worry?

Value loss: If the house is your principle residence that you are living in, as long as you are able to afford the mortgage payment, there is little to worry. The value of living in the house and the saving in rental expense are value to you that should not be impacted by the market trend. As long as the property is a long term investment, you cannot worry too much. After all, you do not realise any gain or loss until you actually sell your property.Sell at a loss: Some people may have purchased a beginner home hoping to upgrade in the future when they build a family or when heir income increase. With market crash and value drop, they make a smaller profit to upgrade to a new house. However, that newer bigger house is also becoming more affordable! However, if you really cannot deal with the idea of selling at a loss, then why not just keep the house? Rent it out! Save up to snatch another beginner house when price is low! You are still owning a house, although not the one you live in.

Wait out the market: You may be thinking that if the property market is calm and normal, you could have purchased a bigger house at the same price. Should I wait it out? Should I wait for the market to cool down? I could time it perfectly and purchase in the cheapest market condition.

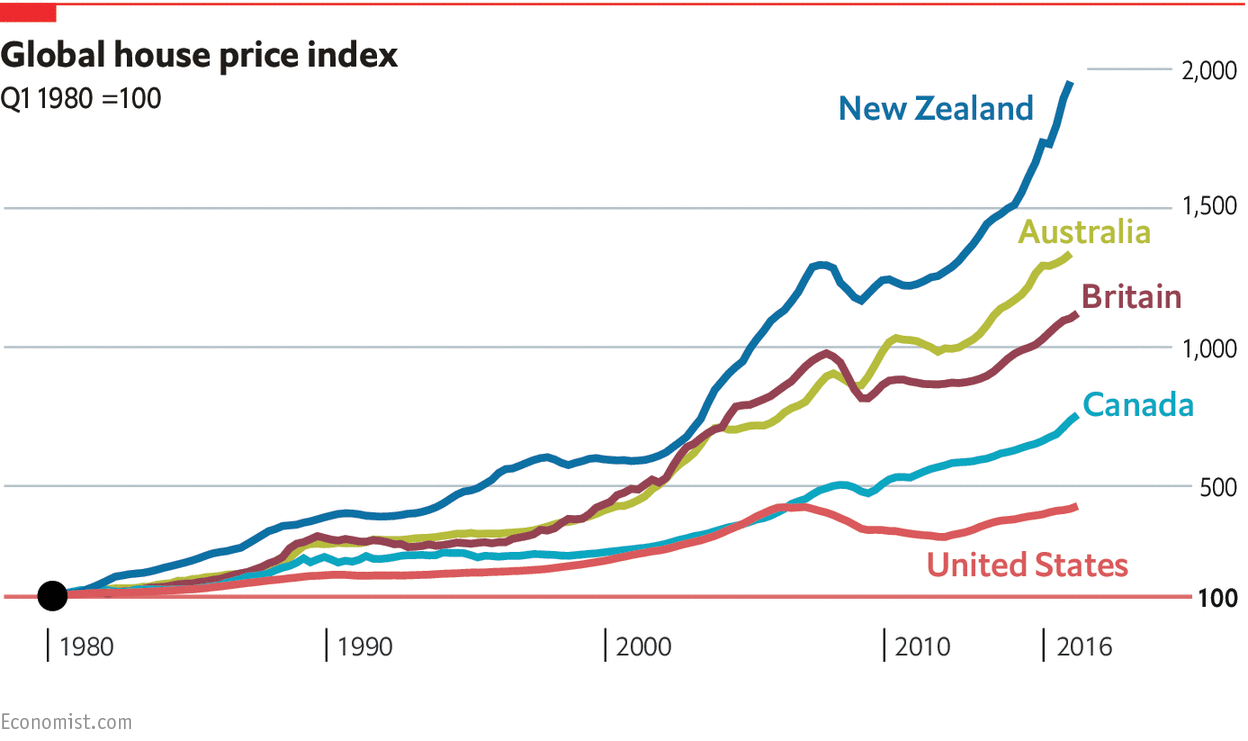

Of course there are lucky investors who took the right bet at the right time and make loads. BUT, have you been waiting for the bubble to burst since 2008 or 9 years ago? It would turned out to be a wrong bet as the market had been rising for 9 years straight (2017). You could have paid $75k on a $400k house in those 9 years.

Source: The Economist

Many people who try to identify the bottom of the market end up wishing "the lowest is yet to come". They think "I know it when I see it" when it comes to a cheap market. However, the market never seems low enough. What is the "bottom"? 10% drop? 20% drop? 30% drop? Market fell briefly in 2009, but it came back up before anyone could react. When the property market really take a plunge by 30%, would the employment market still keep up? Are banks willing to lend you money as easily? Would you be worried the market would tank so you wait further?

"Wait it out" is good for investors who already own a few properties. "Wait it out" is good for young lucky people. For me who wanted to own a home, has sufficient saving, and can afford the mortgage, "wait it out" is a costly mentality.

Riding on the market: In long run, even after a drop value go up again eventually. Even if the value does not go back to to your purchase value, you accumulate equity as you pay down your mortgage. For example, you would have paid $75k on a $400k property at 3% interest rate, 25 years term. Your alternative is to pay rental expense. When I felt the market is prohibitively expensive, I purchased a smaller unit just to ride on the market. I hedged my risk of not owning a property.

Stock is risky, but still trend up eventually.

What to keep in mind when purchasing at the peak of market?

Interest rate hike: One of the scarier part is that property price is high while interest rate is at the bottom. So let's put ourselves through stringent stress test. If the bank want you to go through a 6% interest rate stress test, you put yourself through a 10% interest rate test! If the bank want to ensure your mortgage payment is no more than 60% of your income, you put yourself through a 50% income test! Don't forget to put aside money for the rainy day. Then you are ready for any market condition.We are in it for the long haul: If you don't want to sell your house at a loss in the future, don't even plan about selling! You can live small, you can rent it out. Just hold it out and the market will turn around.

Check your finance: Can I really afford that 2 garage detached? I want to be in the market, but I don't want to stretch myself. How about I buy a semi with front pad parking instead?

Look for undervalued house: Are there even under-valued house these days? There are!

- House hunt over a long weekend

- Get an inspection done on an "as-is" house where less buyers are interested

- Look into areas under gentrification, especially if you don't have kids yet. Like the areas right outside cabbage town.

Buy a solid house: Alternatively buy a solid good house. I know I'm contradicting myself, but these solid houses are those where value stands strong even in the toughest market. You may be paying more now, but you will also be selling for more in any market. What is a solid house?

- Good location - neighbourhood, school catchment, walk score, proximity to park

- Good bone - structure, footprint, lot size, detached/semi/row

- Good curb appeal

- Parking

What should you do if you own a house and you can afford the mortgage? Plan it through different scenario. Then, just sit back, tune out, and enjoy your house!

No comments:

Post a Comment